AI for Insurance Support

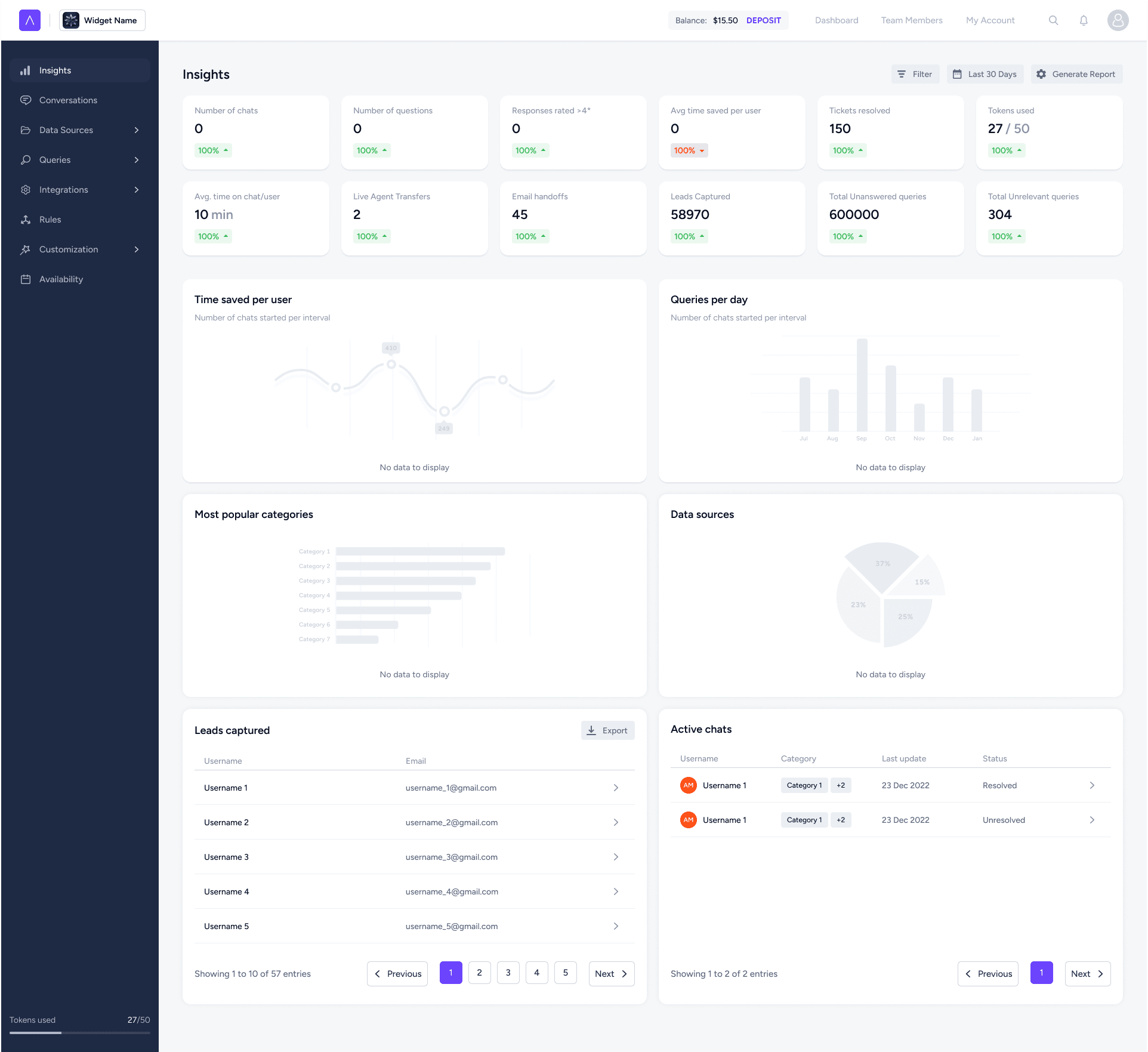

Auralis provides AI insurance claims automation to help insurers handle policy updates, claims, and compliance faster.

Insurance customers expect clear, fast, and empathetic support—especially during critical moments like claims or policy changes. Yet most insurers still rely on manual, agent-heavy processes. This leads to long wait times, backlogs, and inconsistent service. Support teams struggle with high ticket volumes, complex compliance requirements, and legacy systems that limit agility.

80% of insurance customers say claims experience is as important as product pricing

Manual processes add up to 40% in operational costs to claims and service

74% of insurance leaders cite poor digital experiences as a driver of churn

By 2027, AI will automate over 50% of insurance support tasks

What if every customer query—policy changes, claim updates, coverage checks—was resolved instantly, 24/7?

What if every support interaction was compliant by default, with AI monitoring for errors?

What if agents focused only on high-value, complex cases while AI handled the repetitive workload?

Auralis AI agents make this vision a reality, delivering faster, compliant, and more empathetic support at scale.

Subheadiong text

AI answers questions about coverage, benefits, and updates.

Provide real-time claim tracking and updates.

Direct customer issues to the right departments instantly.

AI answers questions about coverage, benefits, and updates.

Duide agents with compliant, accurate responses.

Provide real-time claim tracking and updates.

Keep FAQs and documentation updated and surfaced.

Provide real-time claim tracking and updates.

Provide real-time claim tracking and updates.

Other store owners love Auralis – here’s why

United States

Saas

250,000+

Auralis gave us the tools to engage our congregation in a way we never could before. Volunteer scheduling is smoother, members stay connected, and digital giving has grown significantly. Our staff now spends far less time on repetitive admin and more time focusing on ministry.

Morgan Mudge

Vice President

Eliminate repetitive policy and claims questions.

Instant resolutions

across channels.

Empathetic, always-on digital assistants.

AI audits every conversation in real time.

Agents handle complex cases without backlogs.

Whether it’s help desks, documentation, videos, CRMs, e-commerce, or customer support tools, Auralis enhances your workflow by integrating with all major platforms. Any platform with an API can be integrated with Auralis

We don’t just implement AI — we make it work securely and seamlessly for your business. Starting from extraction and clean-up to ongoing optimization, we are with you every step of the way

We do the hard work. data clean-up, model training, integrations, monitoring, and maintenance — all managed by us, so you don’t need a data science team.

Our solutions are shaped around you. We design, train, and optimize AI on your data and workflows. We don’t take generic models and try to fit you in like most of the other solutions in the market.

Instantly integrates with over 500+ tools that your team already uses out of the box. Anything with an API can be integrated with.

Seamlessly orchestrate public and open-source LLMs — or bring your own — and deploy them anywhere: cloud, private, or on-premise, with full flexibility to match your infrastructure and compliance needs.

Up and running in days, not months. We deliver measurable results quickly, without lengthy implementations or bloated consulting bills.

Compliance you can trust. Certified to industry-leading security and privacy standards (ISO, SOC2, GDPR, HIPAA-ready).

Choosing the right AI agent can make or break your customer experience. This guide walks you through the key questions to ask and factors to consider before investing in an AI agent for your business.

Looking for details to help you decide?

Here's why Auralis help you start saving today!

Auralis automates routine policy queries, claim status updates, premium checks, and payment confirmations across channels. Simple cases are resolved instantly, while complex or sensitive issues are escalated to agents with full context. This reduces wait times and ensures policyholders always get accurate, consistent answers.

Yes. Auralis connects to existing claims platforms, CRMs, and policy systems via APIs, so no rip-and-replace is required. It pulls live data to provide accurate answers without manual lookups. This allows insurers to see ROI quickly while keeping their current infrastructure.

All customer interactions are monitored in real time for compliance with insurance rules and internal policies. Every case is logged with full audit trails, replacing random sampling with 100% coverage. This makes inspections easier and helps reduce regulatory risk.

Yes. AI handles routine requests, but customers can escalate to a human agent at any point. Handover is seamless, with full interaction history passed on so customers don’t need to repeat themselves.

By removing backlogs and delays, customers receive instant, accurate answers for simple requests. Agents have more time to resolve complicated cases with care and attention. This balance improves CSAT scores, retention, and overall trust.

Auralis complies with SOC 2 Type II, ISO 27001, and GDPR standards. Data is encrypted in transit and at rest, and is never used to train external AI models. Insurers retain full control of their information with audit logs and strict data governance.

See what AI-powered support can do for your team with Auralis.